Culture

Ups and Downs: If there’s going to be a financial Armageddon, you’re going to want to follow my economic advice.

Up: Oh good, the world is ending: As most everyone knows by now, the United States has been officially reprimanded for the contentious debt ceiling debate that engulfed the last month of our political lives and served as a reminder that high school Model UN caucuses function better than the federal Congress. The reproach came at the hands of Standard and Poor’s — a credit rating agency that downgraded the country’s sterling AAA rating to a what-the-fuck-does-that-even-mean? AA-Plus. To put that in more practical terms, a AAA rating equates to someone who will immediately pay back the $30 you lent them last weekend, and a AA-Plus rating equates to someone who may or may not default on their multi-trillion dollar debt to China.

Citing the rancor in Congress and the arduous pace at which the debt negotiations proceeded, S&P handed down its decision saying, “The political brinksmanship of recent months highlights what we see as America’s governance and policymaking becoming less stable, less effective, and less predictable than what we previously believed.” And look, I’m not going to argue that the atmosphere in American politics is anything but incredibly toxic, not after longtime Republican Senator Olympia Snowe (Maine) said, “I’ve never seen a worse Congress,” and with congressional approval ratings having dipped to the lowest since the New York Times started asking the question in 1977. But Standard and Poor’s downgrade doesn’t come without a little bit of disbelief, due mainly to two big issues:

1. They don’t actually understand how indebted the country is: When they first announced the rating censure, S&P overestimated the U.S. debt by a not-at-all-scant two trillion dollars. And even after admitting the mistake, the agency refused to alter its rating decision because “None of these key factors was meaningfully affected by the assumption revisions to the assumed growth of discretionary out lays and thus had no impact on the rating decision.” I once tried using this same logic on a debt I owed to the mafia, and all I got was a prison-shank to the upper thigh.*

2. This is all their fault anyway: If the name Standard and Poor’s sounds familiar for something other than its instigation of our shared international financial destruction, it’s because they were involved in our last shared international financial destruction; you know, the one that happened way back in 2008. Prior to that year, S&P had been happily stamping sub-prime mortgage bonds from lenders like Goldman Sachs with its AAA rating – in essence telling investors that they were all but assured to recoup any money spent in purchasing the mortgage bonds. As you might have heard, they didn’t, a financial system built on garbage-loans crashed, we spent trillions of dollars of taxpayer money on Wall Street bailouts, credit and jobs dried up nontheless, and the country was thrust into a recession. You know, the recession that we supposedly hit the floor of months ago. The one we’re really, really hoping not to double-dip back into, but probably will, since the stock market reacted to the AA-Plus rating downgrade by dropping a terrifying 600 points on Monday, shooting up 430 points on Tuesday, and dancing in one spot looking unsure of itself for most of Wednesday. Yes, that’s where you have heard the name S&P before: they are the ones who helped create the crisis in the first place, and now they are punishing us for our inability to adequately respond to all problems they created. That’s like the pot calling the kettle black, then pushing a small child into a pool, and critiquing the kettle’s CPR techniques.

Regardless of its credibility, the S&P downgrade clearly effected the stock market, and we are going to have to be prepared to deal with the consequences, now and in the future.

Fortunately, you know me, and in a past career I was a financial adviser, advocating for a money-management system called “Take It To the Bank!” It was a low-rated public access show in which people would call-in with their money problems. After every piece of advice I offered, I would turn to the camera and scream, “You can Take It To the Bank!”** I am literally the perfect person to steer you through this economic quagmire; all you have to do is keep in mind my three principles of economics:

1: Invest in medicine! It only depreciates in effectiveness, not value. If you’re wondering, “How can I start selling pills out of the back of my station wagon TOMORROW, Ryan!?” all you need to do is: ask your teenage children if you can borrow some of the prescription drugs they undoubtedly have, make a sign that says “Manic Mondays Mobile Medicine Mart!” and glue it to your car, and memorize the license plate numbers of all the unmarked cop cars in your area.

2. Real estate is still the best investment, but as HGTV has taught us, it is only a good investment if the master bathroom has double-sinks. If you have to share a sink with your spouse for even five seconds a day, you might as well burn your house down, because it’s already worthless.

3. Keep a stockpile of money strategically buried in different locations throughout your neighborhood. In the event of a complete economic meltdown, calmly find your shovel, your car keys, and your rifle, and shoot your way to your money.

If Standard and Poor’s were evaluating this financial plan, I feel confident they would assign it their most prestigious rating: AAA-Plus: Solid as a Fucking Rock.

*Lie #1 from this section.

**And there’s lie #2.

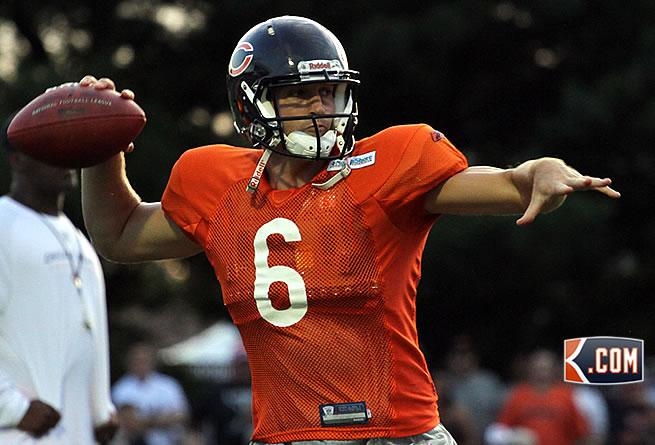

Down: People love to hate Jay Cutler: Trust me, I didn’t want to talk about this again. Fans outside of Chicago might have gotten a respite, but in the lockout-starved NFL offseason, Jay Cutler’s left knee (and his leadership abilities, and his demeanor) were discussed ad nauseam in the city. I don’t really want to recap the entire controversy surrounding his injury in the NFC title game (if you need it, scroll down to the “2010 Season” section), but two bits about Cutler have come up in the past week. The first is a pretty great profile for Sports Illustrated, in which writer Michael Rosenberg tries to make the point that just because Cutler doesn’t always look happy and smiley, it doesn’t mean that he is the scowling asshole that people assume him to be.

Tied to the publication of the story is an interview with Jaguars running back Maurice Jones-Drew, who criticized Cutler via Twitter, and vigorously defended his right to continue to sound like a moron. The real irony of this inane back-and-forth — for me, at least — is that while his team was fighting for the playoffs, Jones-Drew sat out himself for the final two games of the season as he nursed a knee injury. That’s like the pot calling the kettle black, and then tackling the kettle and giving it a grade II medial-collateral ligament tear of the knee.

Just a few points:

1. As Michael Rosenberg points out, why criticize Cutler on his toughness? To recap, he played an entire season with Type-1 Diabetes (and lost 30 pounds in the process), missed only 1 game after getting concussed to shit in game against the Giants in in 2010, and absorbed 52 sacks that same season without complaining once. People don’t seem to like Jay Cutler because of his mannerisms — and that’s fine. But don’t try to backdoor that dislike into some half-baked complaint about his toughness.

2. Remember when ESPN writer Rick Reilly wrote a really lousy piece of commentary criticizing Cutler for not seeking out the media spotlight (and Reilly’s approval)? Remember when Reilly also wrote the script to the movie Leatherheads, and it was unbearably bad?

3. You know who didn’t question Cutler, not even once? His teammates or coaches.

I’m just saying.

Up: Somebody got a degree in marketing: Britain’s beach volleyball team is combining everyone’s two favorite subjects: sex and couponing. In an up-coming exhibition match, two of the team members will have barcodes printed onto the butt of their bikini bottoms. I’m serious. When photographed on smart phones, the barcodes will direct people to specific websites. It’s a marketing idea based on the central question of Kant’s Categorical Imperative: “How can we use this attractive woman’s ass to sell things?”

I tried the exact same thing in my prison yard volleyball team, but it never caught on. What I’m saying is, I was ahead of my time in butt-cheek based advertising.

-

http://twitter.com/HEAVEleen Leen Morrissey